Economy

Amazon Hits 1 Million Robots, Launches DeepFleet AI to Revolutionize Logistics with "Second-Level Response"

Recently, Amazon announced that the number of its robots deployed globally has reached 1 million, and launched a generative AI foundation model named DeepFleet, bringing a major transformation to the logistics industry and opening a new era of "second - level response".

Title: Trump Imposes 50% Punitive Tariffs on Brazil, Launches Unfair - Trade Probe

Local - time on Wednesday, US President Donald Trump turned his trade anger towards Brazil, the largest economy in Latin America. He announced a 50% punitive tariff on Brazilian goods exported to the US and ordered an investigation into "unfair trade practices", which may lead to higher tariffs. The new tariff will take effect on August 1, much higher than the 10% tariff imposed on Brazil on April 2 this year.

New Zealand's S&P/NZX 50 Falls 0.7% as RBNZ Pauses Rate Cuts

New Zealand’s benchmark S&P/NZX 50 index dropped 0.7% to 12,769 on Wednesday, pulling back from a seven-week high hit the previous day, after the Reserve Bank paused its rate-cutting cycle. The central bank kept the cash rate at 3.25% as expected, citing concerns that current inflation and global trade tensions could fuel price pressures. It had cut rates six times since August 2023, totaling 225 basis points, but signaled further cuts may come if inflation eases as projected in May.

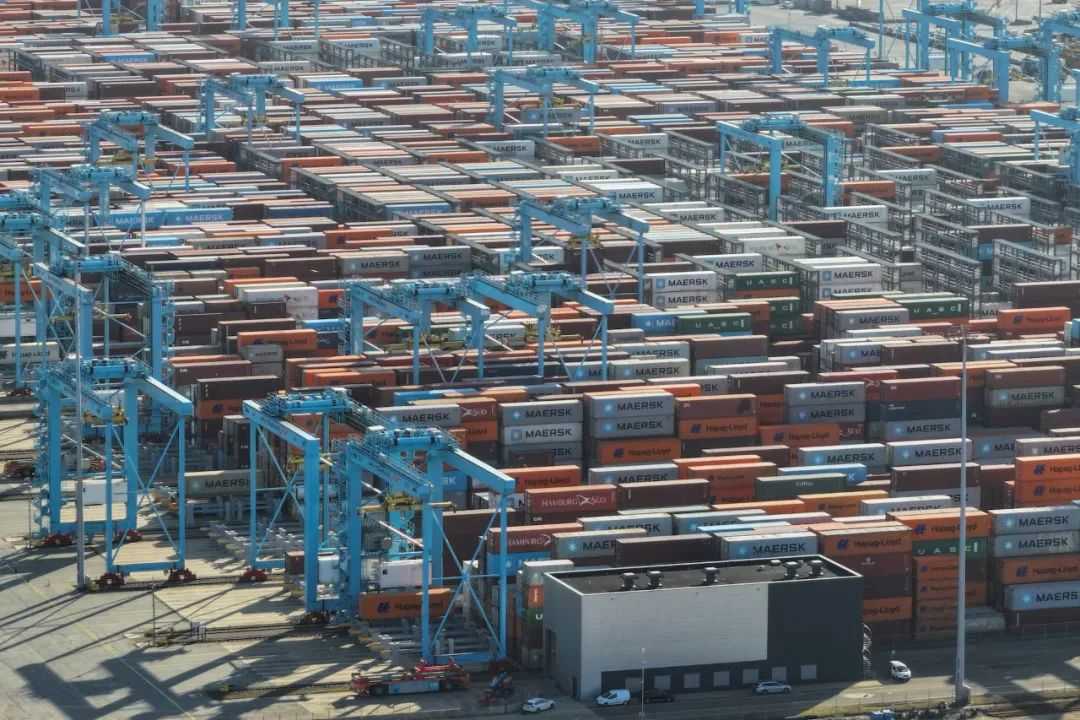

Canada Accelerates Trade Diversification to Counter U.S. Tariff Shocks

Canada is pushing faster trade diversification to fend off U.S. tariff impacts: its U.S. export share dropped 10 percentage points to 68% between May 2024 and May 2025, with auto parts and steel hit hardest. Over the period, U.S.-bound exports fell C$7.7 billion (-15%), while gains to the UK, EU, and Asia-Pacific (C$5.7 billion, +42%) failed to offset the gap.

Canada's S&P/TSX Rises 0.35% as Real Estate Leads, Tariff Impact Muted

Canada’s S&P/TSX Composite Index ended a two-day slide, edging up 0.35% to 26,998.66 on July 9, with real estate stocks leading gains. Markets reacted divergently to Trump’s 50% copper tariff plan (effective as early as late July) and extended trade talks to August 1: the real estate index (.GSPTTRE) rose 0.5% on H&R REIT’s (HR_u.TO) 4.7% surge amid Blackstone acquisition talks.

Trump Escalates Trade War: 25% Tariffs on Japan, South Korea and Others From August

U.S. President Donald Trump announced Monday that the U.S. will impose sharply higher tariffs on multiple trading partners, including Japan and South Korea, starting August 1, marking a new phase in the global trade war he launched earlier this year.

Australian Shares Edge Higher on Wall Street Record; RBA Rate Cut in Focus

Australian stocks rose modestly on Friday (July 5), buoyed by fresh record highs on Wall Street. The S&P/ASX 200 gained 0.17% to 8,610 in midday trade—less than 30 points from its all-time peak—while the All Ordinaries Index added 0.16% to 8,847.3. Despite stronger-than-expected U.S. jobs data dampening hopes for a July Fed rate cut, markets reacted positively to signs of economic resilience.