Economic News

Canada's S&P/TSX Rises 0.35% as Real Estate Leads, Tariff Impact Muted

Canada’s S&P/TSX Composite Index ended a two-day slide, edging up 0.35% to 26,998.66 on July 9, with real estate stocks leading gains. Markets reacted divergently to Trump’s 50% copper tariff plan (effective as early as late July) and extended trade talks to August 1: the real estate index (.GSPTTRE) rose 0.5% on H&R REIT’s (HR_u.TO) 4.7% surge amid Blackstone acquisition talks.

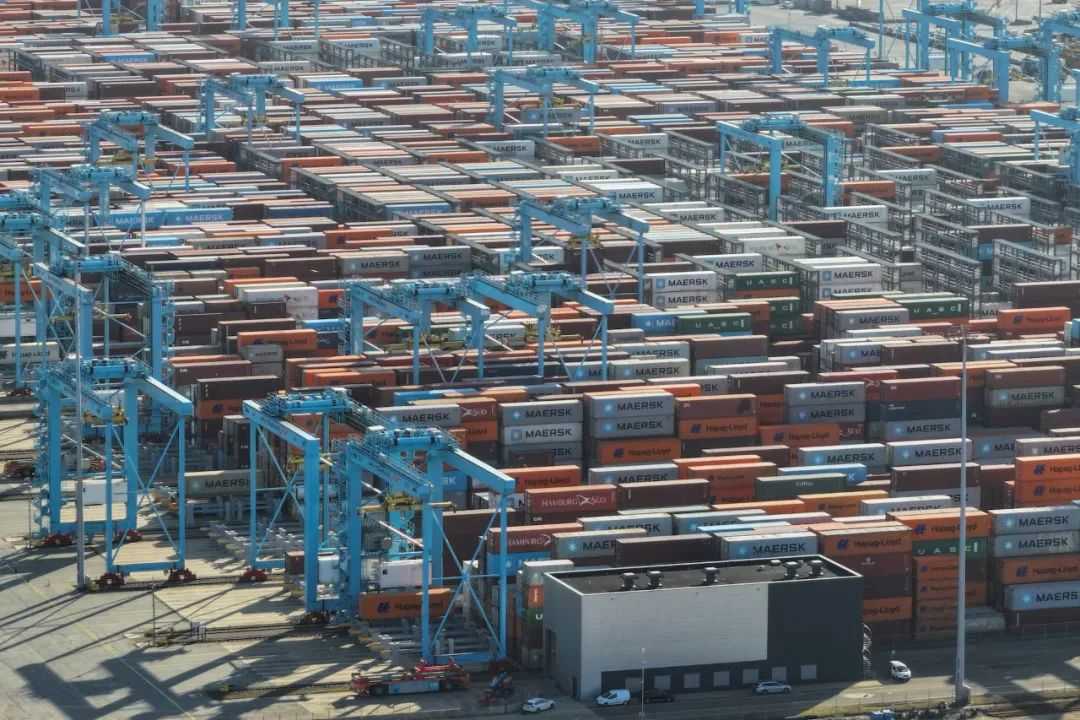

Trump Escalates Trade War: 25% Tariffs on Japan, South Korea and Others From August

U.S. President Donald Trump announced Monday that the U.S. will impose sharply higher tariffs on multiple trading partners, including Japan and South Korea, starting August 1, marking a new phase in the global trade war he launched earlier this year.

Amazon's Dual-Powered Growth: Navigating Challenges and Eyeing New Horizons

Amazon continues to thrive on the twin engines of its e-commerce empire and Amazon Web Services (AWS), with AWS's revenue share climbing to 30% in 2023 while contributing over 60% of the company's profits. This cloud - computing dominance bolsters Amazon's financial strength, even as it confronts intensifying competition from budget - friendly e-commerce rivals like Temu and Shein.

Tesla’s Growth Trajectory: Triumphs, Challenges, and Bold Bets on the Future

Tesla, anchored by its electric vehicle (EV) and energy storage businesses, achieved a significant milestone in 2023 by delivering over 1.8 million vehicles globally. This growth underscores the company’s continued dominance in the EV market. However, the road ahead is paved with obstacles as Tesla navigates intense competition and ambitious technological pursuits under Elon Musk’s leadership.

Australian Shares Edge Higher on Wall Street Record; RBA Rate Cut in Focus

Australian stocks rose modestly on Friday (July 5), buoyed by fresh record highs on Wall Street. The S&P/ASX 200 gained 0.17% to 8,610 in midday trade—less than 30 points from its all-time peak—while the All Ordinaries Index added 0.16% to 8,847.3. Despite stronger-than-expected U.S. jobs data dampening hopes for a July Fed rate cut, markets reacted positively to signs of economic resilience.

UK Retailers in Cost Quagmire as Inflation Worsens and Statistical Reform Looms

The UK retail industry is facing a tough situation as inflationary pressures intensify and statistical reforms are on the horizon. On April 29th, data showed that the inflation rate of grocery prices in the UK climbed to 3.8% (Kantar data), and the food inflation rate reached 2.6% (BRC data), hitting a one - year high. The retail sector is burdened by three major pressures. Firstly, the packaging tax that comes into effect in October will increase the costs of enterprises. Secondly, the Employment Rights Act may lead to more than half of the enterprises scaling back their recruitment.

Japan Considers Easing Import Car Reviews in Bid for Tariff Exemption as US-Japan Tariff Tussle Escalates

On April 29, it was learned that the Japanese government is planning to expand the "Special Treatment System for Imported Automobiles (PHP)". The annual exemption quota for each vehicle model will be increased from 5,000 units. This move is aimed at defusing the US accusation of "non - tariff barriers" against Japan. It is intended to provide bargaining chips for the second round of US - Japan trade negotiations that will kick off on the 30th.

Canada Launches Largest - scale Economic Reform since WWII

Canada's Prime Minister Carney has announced the launch of the largest - scale economic transformation since World War II. The core measures include tax cuts for the middle class starting from July (a two - income family can save 825 Canadian dollars annually), the removal of internal trade barriers within the federation, reducing the proportion of temporary workers and international students to less than 5% by 2027

Japan's Economy Shrinks in Q1 as US Tariffs Hit Auto Industry

Japan's economy is expected to have shrunk by 0.2% on an annualized basis in the first quarter, the first negative growth in a year, according to a Reuters poll. The main reasons are weak domestic demand and imports growing faster than exports. Private consumption increased only slightly by 0.1%, as rising food prices curbed spending. Capital expenditure rose by 0.8%, but net exports dragged down GDP by 0.6%.

London Housing Crisis Worsens: Double Blow of Homelessness and Construction Dilemma

London is facing a worsening housing crisis. In the first quarter of 2025, the number of rough sleepers reached 4,427, an 8% year - on - year increase, hitting a new record high. The government spends £4 million daily to accommodate 183,000 homeless people, including 90,000 children.

New Zealand: Housing Market Shifts to Buyer's Favor, Unemployment Rate May Reach Eight - year High

As winter approaches, New Zealand's real estate market is tilting further towards buyers. In April, the national average asking price for residential properties dropped for the second consecutive month to NZ$851,746, a 3.8% decrease from the peak in February. Major cities like Auckland and Wellington have seen significant declines. The surge in housing supply is the main pressure point, with the number of houses for sale doubling to 35,924 in four years. Although inventory has decreased slightly recently, sales activity has not picked up correspondingly.

Canada's Housing Demand Suppressed by Economic Recession Fears

Canada's housing market is facing a significant downturn as economic recession concerns weigh on potential homebuyers. A recent BMO survey reveals that 73% of would - be purchasers are adopting a wait - and - see attitude due to fears of an economic slump, a 13 - percentage - point increase compared to March.

New Zealand's Trade Shows Positive Signs as Real Estate Market Remains Mixed

On May 5, positive signals emerged in New Zealand's trade sector, with the impact of US - imposed tariffs on agricultural exports proving to be limited. Paul Clark, an economist at Westpac, forecasts that milk prices will remain stable at NZ$10.30 per kilogram this season, potentially edging down to NZ$10 next season, though fluctuations in supply, demand, and exchange rates could still drive prices upward.

UK Stocks Focus on Central Bank Policies: FTSE 100 Slightly Down 0.2% with Precious Metals Sector Leading the Way

On May 6, the UK's FTSE 100 index closed 0.2% lower at 8,143 points. Investors remained cautious ahead of the interest rate decisions of the Federal Reserve and the Bank of England. The mid - cap index, however, bucked the trend and rose 0.6%, achieving a nine - day winning streak. The precious metals sector soared 5.5% boosted by the gold price. Endeavour Mining (+5.2%) and Fresnillo (+4.7%) led the gains among the blue - chip stocks.

First time in 20 years! Google, Android may be divested

First time in 20 years! Google, Android may be divested

The U.S. housing market is about to usher in a new era this weekend.

The U.S. housing market is about to usher in a new era this weekend.

Is the overseas economy about to have a 'hard landing'?

Is the overseas economy about to have a 'hard landing'?

How companies can make the most of digital media

How companies can make the most of digital media