The economy sends mixed signals: Upward pressures include Q1 GDP growth of 0.8%—double the RBNZ’s forecast—and 4.4% year-on-year food price inflation. Downside risks persist, however, with weak retail spending (per capita consumption 6% below 2023 peaks), rising unemployment, stagnant house prices, and a contracting manufacturing sector. BNZ notes the economy "needs more support" and maintains its forecast for the OCR to bottom at 2.75%.

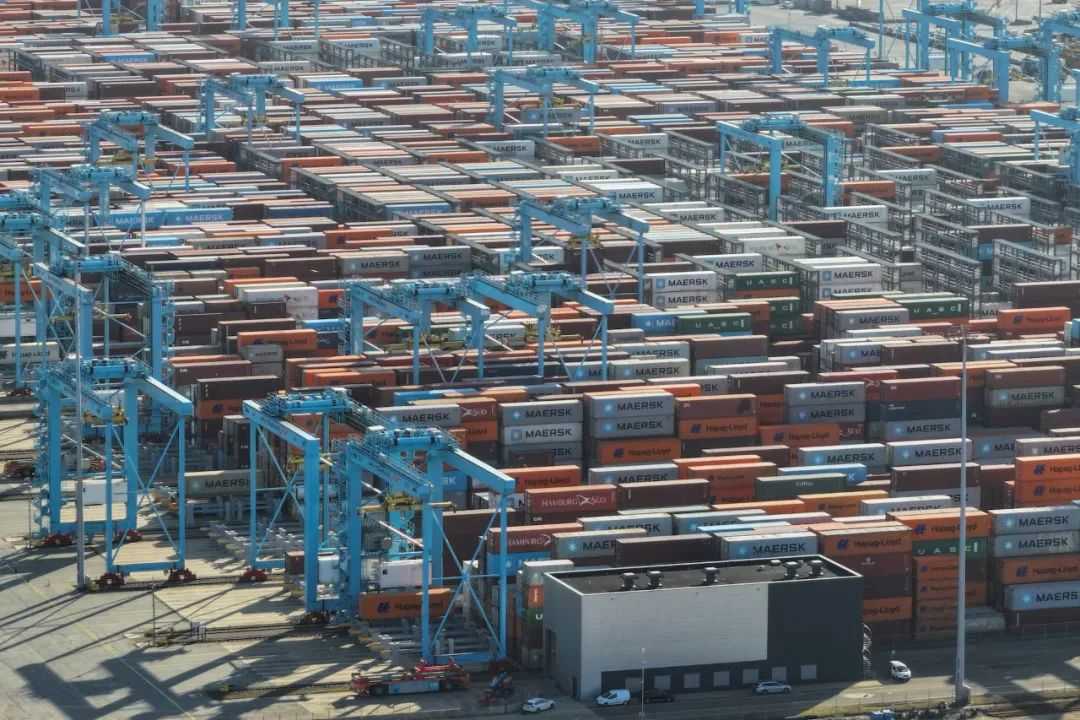

External headwinds loom: The Trump administration’s plans to impose 20–30% tariffs on multiple nations face a July 9 negotiation deadline. Moody’s downgraded 2025 GDP forecasts for 20 out of 25 Asia-Pacific economies, lowering regional growth from 4.0% to 3.3% amid prolonged trade uncertainty. The RBNZ warned in May that "rising global tariffs would delay New Zealand’s economic recovery."

With no Monetary Policy Statement (MPS) accompanying this decision, markets will focus on verbal guidance. A focus on inflation risks could delay easing expectations, while concerns over fragile recovery may hint at potential action in August. Westpac notes that divergent messaging will directly influence wholesale and mortgage rates.